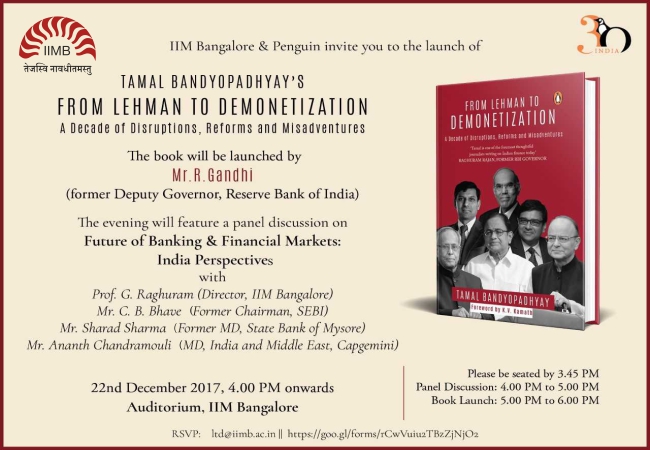

21 December, 2017: As a sequel to the India Finance Conference currently being hosted on its campus, IIM Bangalore is pleased to host a panel discussion on ‘The Future of Banking and Financial Markets: India Perspectives’ and release Tamal Bandyopadhyay’s latest book ‘From Lehman to Demonetization: A Decade of Disruptions, Reforms and Misadventures’.

RSVP either google form https://goo.gl/forms/PcPzxmVl6KQNhH9J3 or an email to ltd@iimb.ac.in.

Tamal Bandyopadhyay’s book captures the events and their ramifications on the Indian financial system over the last 10 years. The panel discussion will focus on the challenges that lie ahead for the Indian financial system over the next ten years.

The discussion will precede the launch of Tamal Bandyopadhyay’s book and will feature an erudite panel comprising:

- Prof. G Raghuram, Director, IIM Bangalore

- C.B. Bhave, Former Chairman, Securities and Exchange Board of India (SEBI)

- Sharad Sharma, Former Managing Director, State Bank of Mysore

- Ananth Chandramouli, Managing Director, India and Middle East, Capgemini

The panel will discuss several aspects that need to be addressed imperatively in the Indian financial system in the coming few years, including the challenge of infrastructure financing, the need for a vibrant corporate bonds and derivatives market in India, issues that need to be addressed and resolved on a priority including the exponential growth in non-performing asset, recapitalization of banks, innovative and disruptive role of fintech, crypto currencies, etc.

Post the panel discussion, R Gandhi, former Deputy Governor of Reserve Bank of India, will release Tamal Bandyopadhyay’s book and the two of them will engage in a discussion on the several issues raised in the book:

- How did the Indian banking system protect itself from the collapse of Lehman Brothers and the global financial crisis of 2008?

- The causes and consequences of high non-performing asset in the Indian banking system

- What nearly wiped out the micro finance sector in India?

- The ‘fractious’ relationship between the Finance Ministry and RBI that saw three Finance Ministers and three RBI Governors in the last decade.

Date: 22nd December (Friday) at 4.00 PM

Venue: Auditorium, IIM Bangalore

21 December, 2017: As a sequel to the India Finance Conference currently being hosted on its campus, IIM Bangalore is pleased to host a panel discussion on ‘The Future of Banking and Financial Markets: India Perspectives’ and release Tamal Bandyopadhyay’s latest book ‘From Lehman to Demonetization: A Decade of Disruptions, Reforms and Misadventures’.

RSVP either google form https://goo.gl/forms/PcPzxmVl6KQNhH9J3 or an email to ltd@iimb.ac.in.

Tamal Bandyopadhyay’s book captures the events and their ramifications on the Indian financial system over the last 10 years. The panel discussion will focus on the challenges that lie ahead for the Indian financial system over the next ten years.

The discussion will precede the launch of Tamal Bandyopadhyay’s book and will feature an erudite panel comprising:

- Prof. G Raghuram, Director, IIM Bangalore

- C.B. Bhave, Former Chairman, Securities and Exchange Board of India (SEBI)

- Sharad Sharma, Former Managing Director, State Bank of Mysore

- Ananth Chandramouli, Managing Director, India and Middle East, Capgemini

The panel will discuss several aspects that need to be addressed imperatively in the Indian financial system in the coming few years, including the challenge of infrastructure financing, the need for a vibrant corporate bonds and derivatives market in India, issues that need to be addressed and resolved on a priority including the exponential growth in non-performing asset, recapitalization of banks, innovative and disruptive role of fintech, crypto currencies, etc.

Post the panel discussion, R Gandhi, former Deputy Governor of Reserve Bank of India, will release Tamal Bandyopadhyay’s book and the two of them will engage in a discussion on the several issues raised in the book:

- How did the Indian banking system protect itself from the collapse of Lehman Brothers and the global financial crisis of 2008?

- The causes and consequences of high non-performing asset in the Indian banking system

- What nearly wiped out the micro finance sector in India?

- The ‘fractious’ relationship between the Finance Ministry and RBI that saw three Finance Ministers and three RBI Governors in the last decade.

Date: 22nd December (Friday) at 4.00 PM

Venue: Auditorium, IIM Bangalore