Centre for Capital Markets and Risk Management hosts webinar on Fund Selection for Investment Portfolios

26 April, 2021: The Centre for Capital Markets and Risk Management at IIM Bangalore organized a series of webinars on the occasion of Global Money Week 2021. Kaustubh Belapurkar, Director-Fund Research at Morningstar India, in his webinar, discussed, in detail, the things to keep in mind while constructing a portfolio.

The cornerstone of investors’ portfolio funds entails 38 fund categories that are defined by SEBI, Investor Asset Allocation and more than 1000 different funds. The asset distribution to a particular portfolio is arrived at by looking at the investor’s risk return objective, time horizon and the further investment goals.

Mutual funds provide a plethora of options. But people tend to gravitate towards the funds that have a recent occurrence in the new due to a temporary outperformance. The types of mutual funds, broadly categorized by SEBI and introduced in 2017, can be listed as:

-

Equity: It comprises 11 sub-categories like Large Cap, Small Cap, Large & Multi Cap, Multi Cap, Flexi Cap, Dividend Yield, Value/Contra, Focused, ELSS and Sectoral/Thematic

-

Debt: This category is divided into 16 subsets as liquid, overnight, money market, ultra-short duration, low duration, short duration, medium duration, medium to long, long duration, dynamic bond, corporate bond, banking and PSU, credit risk Govt bond and 10-year Govt bonds

-

Hybrid: As the name suggests, this is a category developed by combining the other two categories; having seven sub sections under this, they are conservative, balanced, aggressive, dynamic allocation, multi asset, arbitrage and equity savings

-

Others/Solution-Oriented: The final category with four funds has ETF/Index Fund, Fund of Funds-Overseas, retirement and children

Importance of diversification: ‘Don’t put all your eggs in one basket’.

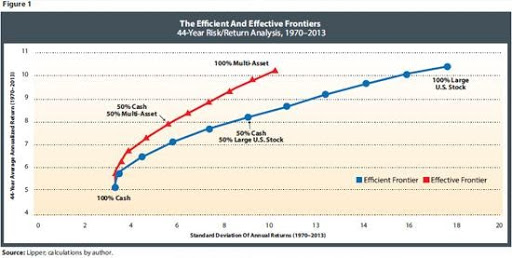

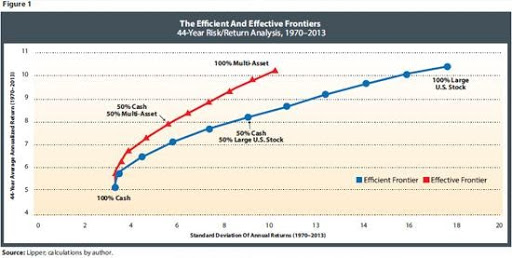

The present market turmoil and economic downturn has opened the eyes of the investors. Unsystematic risks lead to disastrous losses in the fund market. The question that does the rounds is: ‘Why not play safe and only invest in shielded assets like fixed deposits?’ The answer is to look for a higher return with minimal risk. Portfolio managers and fund managers look for the new ‘effective’ frontier in any asset allocation. Effective frontier is collected by plotting a graph of the risk against the returns. The point of optimal risk-return is the effective frontier as shown below:

(Link to the graph: https://www.etf.com/publications/journalofindexes/joi-articles/21291-the-new-effective-frontier.html)

Looking at the various calendar returns for asset classes comprising CRISIL Liquid Fund, CRISIL Composite Bond Fund, CRISIL Short-term Bond Fund, IISL Nifty 50, IISL Nifty Midcap 100, S&P BSE 100, S&P BSE 500 India, S&P BSE Smallcap, S&P 500 and UTI Gold; the results implied that six out of 10 times non-Indian equity asset classes have been the best performers. The performance of every asset class keeps fluctuating over the years based on several factors. The investor should not get swayed by such market turmoil but chase a specific set of funds across asset classes for a long term to maximize returns. Sectoral bifurcation of assets should not be based on short-term risk-return analysis. The pandemic scenario gave a clear picture of returns on IT stocks declining and healthcare sector outperforming its competitors. It is advisable to take guidance from fund managers who handle money matters and are also aware of the market trend and price discovery.

Fund selection techniques: Intensive background research, reading annual reports of firms, learning the fundamental and technical analysis of market scenario is the minimum that an investor should do before entering the fund market. Appropriate fund selection can add significant alpha to portfolios. Long-term fund analysis, assessing the underlying risks, understanding the importance of a longer time span of optimal returns, being patient with the fund manager’s advice as also studying the past performance of a fund is advised by every fund management institute. Behavioral biases like recency bias or herd mentality catches the investment pattern. Perfunctory performance of a fund over the past one year affects the vulnerability of investors. A recent study states the net equity inflows received by one Asset Management Company in 2020, was greater than all other AMCs combined in the same year. People tend to rush to any firm that outperforms the other firms in a short span though their consolidated holding could be much lower than most others. Another study shows that recent performs or short-term performance drives flow into equity funds. This leads to a polarized market.

When constructing a portfolio, a clear goal and estimated return should be the primary focus. Investment span also plays an important role in assessing the risk-return scenario and the asset allocation across funds. As mentioned above, diversification is of prime focus to lessen the risk that might arrive over the investment horizon. Studying the market, keeping monthly track of the fund performance and portfolio reviews give confidence to the investor and helps in rebalancing portfolios to desired asset allocation levels. This in turn leads to removing the more volatile asset classes and includes the more stable ones.

In a study about “Is there a ‘Good Time’ to buy or sell actively managed funds” by Morningstar, for a 10-year period, from July 2009 to June 2019, Indian stocks (passively managed funds) owed all their outperformance to just eight months, or 6.7% of all months. Such was the scenario for most Indian actively managed diversified equity funds’ outperformance. It can be inferred that investors are keener to time investments in actively managed funds. This is not advised for a healthy return. A person must be invested for a sufficient horizon for likely return than chasing returns over a tiny span.

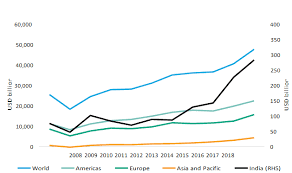

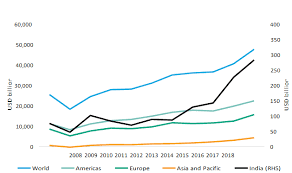

The graph shows that growth in the investors account is rising every year. The retail investments and HNI (High Networth Individual) investor accounts are growing continuously but the growth in HNI is steeper than retail investors. A comparative study reveals that investment in equity fund is growing more than equity index. The greater picture is that the growth rate of Indian mutual fund asset is higher than Europe and Asia-Pacific regions but is in alignment with the United States.

Mutual fund selection techniques:

-

Quantitative Analysis: Fundamental analysis, historical performance, volatility smiles, risk-return ratios, Z-scores and credit rating remain the most common methods for fund selection

-

Qualitative Analysis: Annual reports, evaluation of people & process driving the strategy, fund managers’ historical styles, performance attribution of funds can give a better insight into the sources of alpha to a portfolio; also building a portfolio of diverse managers’ styles can keep the fund safe from inflation

Morningstar states that funds with lower returns could have a higher Morningstar Risk Adjusted Return (MRAR). The MRAR measures the returns of the portfolio, adjusted for the risk of the portfolio relative to that of some benchmark (eg. market). It lists the less volatile funds which do not fall on the downside of the benchmark on a relative context. This is the basis of the Morningstar ‘Star Ratings’ which looks at the long-term risk adjusted return funds and compares them to the peer group to begin with the shortlisting process. Capitalization on size factor which speaks for a combination of large, mid and small caps as bucketed by SEBI makes it easy to identify potential asset allocation structures. Ensuring a fund lies within the style box to maximize returns with minimal risks:

|

Value |

Blend |

Growth |

|

|

|

|

|

|

Large |

|

|

|

|

|

Mid |

|

|

|

|

|

Small |

|

Morningstar Style Box

Popular style box analysis can be found on the website of Morningstar. For an instance, Mirae India Large Cap mostly concentrates on the Large Cap Blend part of the style box, HDFC Top 100 shares half of its assets in the Value and Growth boxes with the other half concentrating on the Blend box, Axis Bluechip divides its assets between the blend and the growth of the style box. Adding these to one’s portfolio we get an all-weather Equity large cap portfolio. Diversification and holding on to a fund are extremely important for consistent earnings.

Centre for Capital Markets and Risk Management hosts webinar on Fund Selection for Investment Portfolios

26 April, 2021: The Centre for Capital Markets and Risk Management at IIM Bangalore organized a series of webinars on the occasion of Global Money Week 2021. Kaustubh Belapurkar, Director-Fund Research at Morningstar India, in his webinar, discussed, in detail, the things to keep in mind while constructing a portfolio.

The cornerstone of investors’ portfolio funds entails 38 fund categories that are defined by SEBI, Investor Asset Allocation and more than 1000 different funds. The asset distribution to a particular portfolio is arrived at by looking at the investor’s risk return objective, time horizon and the further investment goals.

Mutual funds provide a plethora of options. But people tend to gravitate towards the funds that have a recent occurrence in the new due to a temporary outperformance. The types of mutual funds, broadly categorized by SEBI and introduced in 2017, can be listed as:

-

Equity: It comprises 11 sub-categories like Large Cap, Small Cap, Large & Multi Cap, Multi Cap, Flexi Cap, Dividend Yield, Value/Contra, Focused, ELSS and Sectoral/Thematic

-

Debt: This category is divided into 16 subsets as liquid, overnight, money market, ultra-short duration, low duration, short duration, medium duration, medium to long, long duration, dynamic bond, corporate bond, banking and PSU, credit risk Govt bond and 10-year Govt bonds

-

Hybrid: As the name suggests, this is a category developed by combining the other two categories; having seven sub sections under this, they are conservative, balanced, aggressive, dynamic allocation, multi asset, arbitrage and equity savings

-

Others/Solution-Oriented: The final category with four funds has ETF/Index Fund, Fund of Funds-Overseas, retirement and children

Importance of diversification: ‘Don’t put all your eggs in one basket’.

The present market turmoil and economic downturn has opened the eyes of the investors. Unsystematic risks lead to disastrous losses in the fund market. The question that does the rounds is: ‘Why not play safe and only invest in shielded assets like fixed deposits?’ The answer is to look for a higher return with minimal risk. Portfolio managers and fund managers look for the new ‘effective’ frontier in any asset allocation. Effective frontier is collected by plotting a graph of the risk against the returns. The point of optimal risk-return is the effective frontier as shown below:

(Link to the graph: https://www.etf.com/publications/journalofindexes/joi-articles/21291-the-new-effective-frontier.html)

Looking at the various calendar returns for asset classes comprising CRISIL Liquid Fund, CRISIL Composite Bond Fund, CRISIL Short-term Bond Fund, IISL Nifty 50, IISL Nifty Midcap 100, S&P BSE 100, S&P BSE 500 India, S&P BSE Smallcap, S&P 500 and UTI Gold; the results implied that six out of 10 times non-Indian equity asset classes have been the best performers. The performance of every asset class keeps fluctuating over the years based on several factors. The investor should not get swayed by such market turmoil but chase a specific set of funds across asset classes for a long term to maximize returns. Sectoral bifurcation of assets should not be based on short-term risk-return analysis. The pandemic scenario gave a clear picture of returns on IT stocks declining and healthcare sector outperforming its competitors. It is advisable to take guidance from fund managers who handle money matters and are also aware of the market trend and price discovery.

Fund selection techniques: Intensive background research, reading annual reports of firms, learning the fundamental and technical analysis of market scenario is the minimum that an investor should do before entering the fund market. Appropriate fund selection can add significant alpha to portfolios. Long-term fund analysis, assessing the underlying risks, understanding the importance of a longer time span of optimal returns, being patient with the fund manager’s advice as also studying the past performance of a fund is advised by every fund management institute. Behavioral biases like recency bias or herd mentality catches the investment pattern. Perfunctory performance of a fund over the past one year affects the vulnerability of investors. A recent study states the net equity inflows received by one Asset Management Company in 2020, was greater than all other AMCs combined in the same year. People tend to rush to any firm that outperforms the other firms in a short span though their consolidated holding could be much lower than most others. Another study shows that recent performs or short-term performance drives flow into equity funds. This leads to a polarized market.

When constructing a portfolio, a clear goal and estimated return should be the primary focus. Investment span also plays an important role in assessing the risk-return scenario and the asset allocation across funds. As mentioned above, diversification is of prime focus to lessen the risk that might arrive over the investment horizon. Studying the market, keeping monthly track of the fund performance and portfolio reviews give confidence to the investor and helps in rebalancing portfolios to desired asset allocation levels. This in turn leads to removing the more volatile asset classes and includes the more stable ones.

In a study about “Is there a ‘Good Time’ to buy or sell actively managed funds” by Morningstar, for a 10-year period, from July 2009 to June 2019, Indian stocks (passively managed funds) owed all their outperformance to just eight months, or 6.7% of all months. Such was the scenario for most Indian actively managed diversified equity funds’ outperformance. It can be inferred that investors are keener to time investments in actively managed funds. This is not advised for a healthy return. A person must be invested for a sufficient horizon for likely return than chasing returns over a tiny span.

The graph shows that growth in the investors account is rising every year. The retail investments and HNI (High Networth Individual) investor accounts are growing continuously but the growth in HNI is steeper than retail investors. A comparative study reveals that investment in equity fund is growing more than equity index. The greater picture is that the growth rate of Indian mutual fund asset is higher than Europe and Asia-Pacific regions but is in alignment with the United States.

Mutual fund selection techniques:

-

Quantitative Analysis: Fundamental analysis, historical performance, volatility smiles, risk-return ratios, Z-scores and credit rating remain the most common methods for fund selection

-

Qualitative Analysis: Annual reports, evaluation of people & process driving the strategy, fund managers’ historical styles, performance attribution of funds can give a better insight into the sources of alpha to a portfolio; also building a portfolio of diverse managers’ styles can keep the fund safe from inflation

Morningstar states that funds with lower returns could have a higher Morningstar Risk Adjusted Return (MRAR). The MRAR measures the returns of the portfolio, adjusted for the risk of the portfolio relative to that of some benchmark (eg. market). It lists the less volatile funds which do not fall on the downside of the benchmark on a relative context. This is the basis of the Morningstar ‘Star Ratings’ which looks at the long-term risk adjusted return funds and compares them to the peer group to begin with the shortlisting process. Capitalization on size factor which speaks for a combination of large, mid and small caps as bucketed by SEBI makes it easy to identify potential asset allocation structures. Ensuring a fund lies within the style box to maximize returns with minimal risks:

|

Value |

Blend |

Growth |

|

|

|

|

|

|

Large |

|

|

|

|

|

Mid |

|

|

|

|

|

Small |

|

Morningstar Style Box

Popular style box analysis can be found on the website of Morningstar. For an instance, Mirae India Large Cap mostly concentrates on the Large Cap Blend part of the style box, HDFC Top 100 shares half of its assets in the Value and Growth boxes with the other half concentrating on the Blend box, Axis Bluechip divides its assets between the blend and the growth of the style box. Adding these to one’s portfolio we get an all-weather Equity large cap portfolio. Diversification and holding on to a fund are extremely important for consistent earnings.