Centre for Software & IT Management hosts panel on AI, Crypto & Social Algorithm in the Future of Finance

Discussion gathered eminent finance experts from Federal Reserve Bank of Philadelphia, Cambridge University and Indiana University

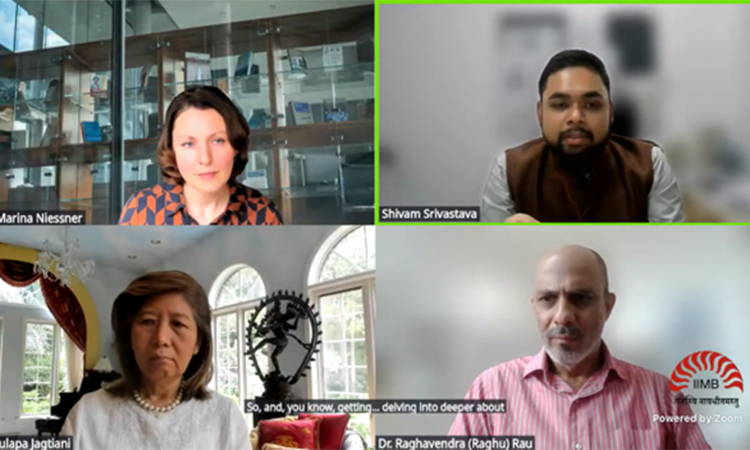

20 August, 2025, Bengaluru: The Centre for Software and IT Management (CSITM) at IIM Bangalore hosted a webinar titled ‘Beyond Intuition: AI, Crypto, and Social Algorithms Shaping the Future of Finance’, which attracted nearly 200 participants and gathered eminent finance experts from the U.S., the United Kingdom, and India. The panel comprised Dr. Julapa Jagtiani, Senior Economic Advisor and Economist at the Federal Reserve Bank of Philadelphia; PGP 1989 alumnus and DAA 2022 recipient Prof. Raghavendra (Raghu) Rau, Sir Evelyn de Rothschild Professor of Finance at Cambridge Judge Business School; and Dr. Marina Niessner, Assistant Professor of Finance at Indiana University’s Kelley School of Business. The session was moderated by Shivam Srivastava, Consultant, CSITM.

AI and Financial Inclusion

Opening the session was Dr. Julapa Jagtiani, who spoke on the ways Artificial Intelligence (AI) and non-traditional data are reshaping credit access. “In essence, they are using artificial intelligence to find what we refer to as the invisible prime borrowers – those who are non-prime appearing but are otherwise not riskier. That’s what artificial intelligence has been doing to uplift credit access – bringing all of us closer to a more inclusive financial system,” she stated.

She noted that bank-fintech collaborations have allowed for more proper pricing and risk underwriting: “When banks team up with vendors of AI solutions, we see more correct pricing of non-prime borrowers. Rather than pricing all as equally risky, AI differentiates who will default and who will not.”

Dr. Jagtiani also discussed the role of stablecoins, noting that they have been used mainly to support crypto trading until now, however, “they may play a significant role in financial inclusion because all you need is a cell phone – you don’t need to have a bank account or credit history”.

AI in Finance: Hopes and Risks

Professor Raghavendra Rau gave a critical evaluation of AI models, deliberating on their foundations in classic predictive learning methods and their potential and limitations. He warned that modern AI systems, including large language models such as ChatGPT, are clever statistical machines devoid of actual understanding. This inherent trait can cause mistakes or "hallucinations," especially dangerous when employed in high-stakes financial judgments. Though AI has powerful forecasting abilities, Prof. Rau underlined that explainability is essential for regulators and financial institutions to adequately deal with risks in the face of potential regime changes or black swan events.

Taking a more critical view towards the hasty and rapid acceleration in the infusion of AI into finance, Professor Rau noted that AI essentially depends on matrix multiplication with weights and thresholds and cannot provide genuine comprehension of financial situations. He cautioned against it, adding that although finance produces enormous amounts of data that is customarily regarded as a perfect breeding ground for AI, models are no better than the assumptions and information they are based on. The usefulness of AI in finance should therefore not be overestimated, and its forecasts treated with caution.

Social Media and Investor Behavior

Dr. Marina Niessner noted that financial social media and online narratives have begun to increasingly contribute to investment decisions. “We find financial social media to have a powerful influence on trading volumes, often contradicting fundamentals. Crypto celebrity tweets, as an example, can trigger bigger-than-8-percent intraday jumps – but conclude with loss of returns on average by followers”, she explained. She warned of greater threats to market confidence, saying, “Access to counterfeit or misleading financial content damages not only individual investors but lowers confidence in financial markets as a whole and discourages engagement with genuine content”.

Call for Balanced Regulation

Throughout the forum, panelists concurred with the need for an even-handed regulatory agenda that promotes innovation while safeguarding consumers. Transparency, constant model refinement to meet shifting environments, enforcement of disclosures in celebrity endorsements, and regulation of fintech collaborations with banks were named as crucial elements of an effective regulatory agenda in this fast-changing financial landscape.

The discussion also called for the urgent interplay of innovative technology and finance, stressing that though AI, cryptocurrency, and social media have unparalleled potential for financial inclusion, they pose novel risks that are to be addressed sensibly.

The session ended with an interactive Q&A segment, which touched on topics ranging from the question of AI bias to the prospects of tokenized assets. The session highlighted both the opportunities and pitfalls of algorithm-driven finance and solidified CSITM’s mission to promote discussion at this nexus of technology, markets, and governance.

Centre for Software & IT Management hosts panel on AI, Crypto & Social Algorithm in the Future of Finance

Discussion gathered eminent finance experts from Federal Reserve Bank of Philadelphia, Cambridge University and Indiana University

20 August, 2025, Bengaluru: The Centre for Software and IT Management (CSITM) at IIM Bangalore hosted a webinar titled ‘Beyond Intuition: AI, Crypto, and Social Algorithms Shaping the Future of Finance’, which attracted nearly 200 participants and gathered eminent finance experts from the U.S., the United Kingdom, and India. The panel comprised Dr. Julapa Jagtiani, Senior Economic Advisor and Economist at the Federal Reserve Bank of Philadelphia; PGP 1989 alumnus and DAA 2022 recipient Prof. Raghavendra (Raghu) Rau, Sir Evelyn de Rothschild Professor of Finance at Cambridge Judge Business School; and Dr. Marina Niessner, Assistant Professor of Finance at Indiana University’s Kelley School of Business. The session was moderated by Shivam Srivastava, Consultant, CSITM.

AI and Financial Inclusion

Opening the session was Dr. Julapa Jagtiani, who spoke on the ways Artificial Intelligence (AI) and non-traditional data are reshaping credit access. “In essence, they are using artificial intelligence to find what we refer to as the invisible prime borrowers – those who are non-prime appearing but are otherwise not riskier. That’s what artificial intelligence has been doing to uplift credit access – bringing all of us closer to a more inclusive financial system,” she stated.

She noted that bank-fintech collaborations have allowed for more proper pricing and risk underwriting: “When banks team up with vendors of AI solutions, we see more correct pricing of non-prime borrowers. Rather than pricing all as equally risky, AI differentiates who will default and who will not.”

Dr. Jagtiani also discussed the role of stablecoins, noting that they have been used mainly to support crypto trading until now, however, “they may play a significant role in financial inclusion because all you need is a cell phone – you don’t need to have a bank account or credit history”.

AI in Finance: Hopes and Risks

Professor Raghavendra Rau gave a critical evaluation of AI models, deliberating on their foundations in classic predictive learning methods and their potential and limitations. He warned that modern AI systems, including large language models such as ChatGPT, are clever statistical machines devoid of actual understanding. This inherent trait can cause mistakes or "hallucinations," especially dangerous when employed in high-stakes financial judgments. Though AI has powerful forecasting abilities, Prof. Rau underlined that explainability is essential for regulators and financial institutions to adequately deal with risks in the face of potential regime changes or black swan events.

Taking a more critical view towards the hasty and rapid acceleration in the infusion of AI into finance, Professor Rau noted that AI essentially depends on matrix multiplication with weights and thresholds and cannot provide genuine comprehension of financial situations. He cautioned against it, adding that although finance produces enormous amounts of data that is customarily regarded as a perfect breeding ground for AI, models are no better than the assumptions and information they are based on. The usefulness of AI in finance should therefore not be overestimated, and its forecasts treated with caution.

Social Media and Investor Behavior

Dr. Marina Niessner noted that financial social media and online narratives have begun to increasingly contribute to investment decisions. “We find financial social media to have a powerful influence on trading volumes, often contradicting fundamentals. Crypto celebrity tweets, as an example, can trigger bigger-than-8-percent intraday jumps – but conclude with loss of returns on average by followers”, she explained. She warned of greater threats to market confidence, saying, “Access to counterfeit or misleading financial content damages not only individual investors but lowers confidence in financial markets as a whole and discourages engagement with genuine content”.

Call for Balanced Regulation

Throughout the forum, panelists concurred with the need for an even-handed regulatory agenda that promotes innovation while safeguarding consumers. Transparency, constant model refinement to meet shifting environments, enforcement of disclosures in celebrity endorsements, and regulation of fintech collaborations with banks were named as crucial elements of an effective regulatory agenda in this fast-changing financial landscape.

The discussion also called for the urgent interplay of innovative technology and finance, stressing that though AI, cryptocurrency, and social media have unparalleled potential for financial inclusion, they pose novel risks that are to be addressed sensibly.

The session ended with an interactive Q&A segment, which touched on topics ranging from the question of AI bias to the prospects of tokenized assets. The session highlighted both the opportunities and pitfalls of algorithm-driven finance and solidified CSITM’s mission to promote discussion at this nexus of technology, markets, and governance.