What does India’s economic stimulus offer to the poor?

- By Prateek Raj --

- June 02, 2020

Stimulus Package, Relief, Poor, MSME, Migrant Workers

The Indian stimulus package offers around 0.55% of the GDP (around Rs 1.1 lack crore) as immediate measures for the poor, in which 0.31% of the GDP is in-kind transfers, most of which were offered on 26th March 2020. May month measures did not offer substantial relief for the immediate needs of the poor.

The economic stimulus packages being offered in response to the COVID-19 crisis, are like a fruit basket with a motley of measures. Each measure is different, based on the intended beneficiary, the level of immediacy and the instrument of relief. This article identifies stimulus measures announced by the Indian government where the poor or their employers are direct beneficiaries, and which are intended to immediately provide them relief.

Direct in-kind measures: The largest stimulus measure by the Indian government was announced on 26th March 2020, a day after the beginning of the lockdown. It provided 800 million poor individuals with 5 kg of wheat/rice per month, and 1 kg of pulses per household per month, for three months. The total fiscal cost of this measure was estimated to be Rs 45000 crore (USD 6 billion). A follow up to this scheme was announced on 14th May 2020 when 80 million migrant workers - including those who did not have proper identification - were included in the scheme (for 2 months) at a stated fiscal cost of Rs 3500 crore (USD 467 million). In a related measure the government also announced on 26th March 2020 a provision of LPG cylinders for 3 months to 80 million households, at a fiscal cost of Rs 13000 crore (USD 1.73 billion).

These in-kind transfers worth Rs 61500 crore (USD 8.2 billion) are welcome measures that are providing necessary relief to hundreds of millions Indians. Based on the 26th March announcements, per capita, a poor person was promised grain transfers worth (cost to government) Rs 560 (USD 7.5), and a poor household was promised an LPG transfer worth Rs 1625 (USD 22). Of course, for a program of such a scale, there have also been leakages in the implementation of this relief, due to lack of accessibility or endemic corruption, an example of which has been reported in Jharkhand.

Direct cash measures: Along with the in-kind transfers, specific vulnerable groups have been provided direct cash and income transfers. These beneficiaries include 204 million women who receive Rs 1500 (USD 20 in three monthly instalments) through their Jan Dhan Bank accounts at a fiscal cost of Rs 30600 crore (USD 4.08 billion). 30 million poor widows, senior citizens and disabled receive a one-time payment of Rs 1000 (USD 13) at a fiscal cost of Rs 3000 crore (USD 400 million). 7.2 million workers with a monthly income of less than Rs 15000 (USD 200) in firms with fewer than 100 employees, get 24% of their monthly salary paid by the government for 3 months, at an expected fiscal cost of Rs 2800 crore (USD 373 million)1. This scheme was further extended for 3 more months at a stated fiscal cost of Rs 2800 crore (USD 373 million). The government has also made a wage increase of Rs 20 (USD 0.27) per day for MNREGA workers helping 136 million individuals at a fiscal cost of Rs 5600 crore (USD 747 million).

Although these transfers are worth Rs 39200 crore (USD 5.2 billion), the size of relief per capita is very small. For example the three Rs 500 per month instalments to 204 million women is inadequate to provide a sizeable relief. A paucity of cash has important negative ramifications on local demand, and as a consequence on the local economies. Hence, helping the poor through cash may be an important step in reviving local economies.

Other direct measures: Additionally the government has promised to create a fund for stressed MSMEs with a stated commitment of credit guarantee of Rs 4000 crore (USD 533 million), helping 200 thousand MSMEs. This is a welcome measure to help small businesses and their employees in distress.

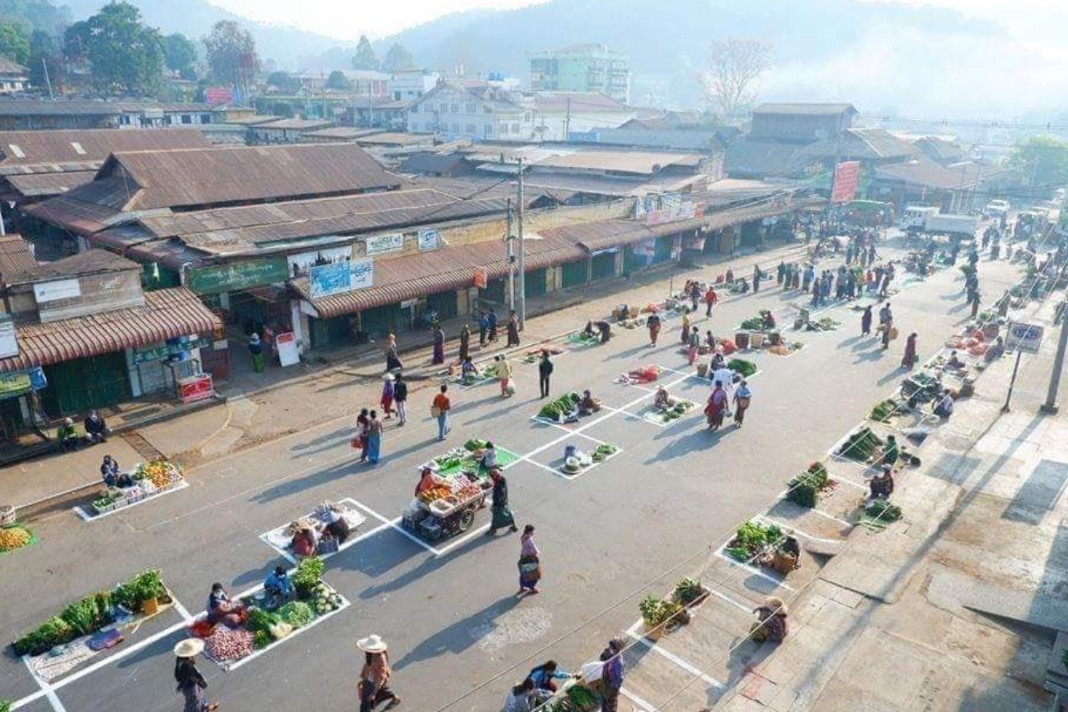

Other measures: To help urban migrant workers the government, on 26th March 2020, directed state governments to utilise Rs 31000 crore (USD 4.1 billion) of the existing welfare fund for building and construction workers, to help 35 million workers enrolled in the fund. This fund helped state governments finance their relief measures. However a report by SWAN (Stranded Workers Action Network) showcased that even after 32 days of lockdown 97% of the migrants they surveyed had not received cash relief, 82% had not received food grains, and 68% did not have access to cooked meals. The government plans to provide an advance payment of Rs 2000 (USD 260 million) to 87 million farmers who are part of the PM-Kisan Yojana, which incurs no additional fiscal cost.

30 million small and marginal farmers are also expected to receive additional working capital through NABARD which will lead to cash infusion of RS 30000 crore (USD 4 billion). Similarly the government promises to provide working credit of up to Rs 10000 (USD 133) to 5 million street vendors leading to cash infusion of Rs 5000 crore (USD 666 million). A similar mega measure of credit infusion has been offered to 4.5 million MSMEs leading to cash infusion of Rs 200000 crore (USD 26.7 billion), helping them stay afloat saving jobs. Each of these measures, although incur no fiscal cost on the governments, are welcome steps to provide relief to small businesses, employees, micro entrepreneurs, and workers for survival.

Summary

The overall fiscal cost of the stimulus package for immediate relief to the poor is about Rs 110300 crore (USD 14.7 billion), that amounts to around 0.55% of the GDP in which 0.31% of the GDP is in-kind transfers. The overall stimulus is estimated by various agencies to have a fiscal cost of around 1% and it is encouraging to see that more than half of those fiscally costly measures are directed for the poor. Yet it is also worth noticing that most of these measures for the poor were already announced on 26th March 2020. In fact, in the much awaited wave of “self-reliant India” announcements in May, only three measures with a fiscal cost of Rs 10300 crore (USD 1.37 billion), were of direct relevance to the poor, although a variety of credit infusion measures were taken to help businesses that employ them. Hence, the second wave of announcements in the month of May have been a lost opportunity for providing more immediate relief to the poor. Given the scale of India’s poverty, severity of its lockdown, and the bullish growth prospects in the long term, there is space for more spending on the poor, which the government should focus on.

Schemes offering immediate benefits to the poor

|

# |

Date |

Beneficiary |

Beneficiary size |

Stated measure |

Type |

Cost (Rs crore) |

|

1 |

26-Mar-20 |

Individuals: Poor families (PDS) |

800,000,000 individuals |

5 kg wheat/rice per person, 1 kg pulses per household for 3 months |

Direct |

45000 |

|

2 |

26-Mar-20 |

Individuals: Farmers (PM Kisan) |

87,000,000 farmers |

Front load Rs 2000 payment |

Advance |

n.a. |

|

3 |

26-Mar-20 |

Individuals: Poor women (Jan Dhan) |

204,000,000 women |

Rs 500 per month through Jan Dhan for 3 months |

Direct |

30600 |

|

4 |

26-Mar-20 |

Individuals: Poor families (Ujjwala Yojana) |

80,000,000 households |

Gas cylinder provided to each family for 3 months |

Direct |

13000 |

|

5 |

26-Mar-20 |

Businesses and Individuals: Small organized firms and employees |

7,222,000 employees |

24% of wage contribution in EPF account for workers income <Rs 15000 in business with < 100 workers |

Direct |

2800 |

|

6 |

26-Mar-20 |

Individuals: Poor Widows, senior citizens, divyang |

30,000,000 individuals |

Rs 1000 one time payment |

Direct |

3000 |

|

7 |

26-Mar-20 |

Individuals: Poor |

136,299,999 individuals |

Rs 20 increase in minimum wage in MNREGA from Rs 182 to Rs 202 |

Direct |

5600 |

|

8 |

26-Mar-20 |

Individuals: Workers Building and construction |

35,000,000 individuals |

State governments utilize Rs 31000 crore welfare fund |

Advance |

n.a. |

|

9 |

13-May-20 |

Businesses: MSME (upto 100 cr turnover and 25 cr outstanding) |

4,500,000 businesses |

Emergency credit line upto 20% of outstanding credit (Rs 3 lack crore) |

Credit/Liquiidity |

n.a. |

|

10 |

13-May-20 |

Businesses: MSME (Stressed) |

200,000 businesses |

Subordinate debt for stressed MSMEs (Rs 20000 crore) |

Credit/Liquiidity |

4000 |

|

11 |

13-May-20 |

Businesses and Individuals: Small organized firms and employees |

7,222,000 employees |

24% of wage contribution in EPF account for workers income <Rs 15000 in business with < 100 workers |

Direct |

2800 |

|

12 |

14-May-20 |

Individuals: Workers Migrants |

80,000,000 individuals |

5 kg wheat/rice per person, 1 kg pulses per migrant for 2 months |

Direct |

3500 |

|

13 |

14-May-20 |

Individuals: Street Vendors |

5,000,000 vendors |

Working capital upto Rs 10,000 (Rs 5000 crore) |

Credit/Liquiidity |

n.a. |

|

14 |

14-May-20 |

Individuals: Farmers small and marginal |

30,000,000 farmers |

Additional Emergency Working Capital through NABARD (Rs 30000 crore) |

Credit/Liquiidity |

n.a. |

|

Total: |

110300 |

|||||

Prateek Raj