India Real Estate: Challenges and Opportunities presented by COVID-19 - I

- By Shwetha Pai and Venkatesh Panchapagesan--

- July 27, 2020

Share This Story

Real Estate, Slowdown, Recovery, Technology

The impact of COVID-19 on the global economy is likened to that of the Great Depression of 1930s. The Real Estate Research Initiative (RERI) at IIM Bangalore conducted a survey to understand the business impact of COVID -19 on real estate companies in India. Click the link for the survey report - https://www.iimb.ac.in/state-sector-impact-covid-19-indian-res. This is a series based on the data and insights from this survey. The first article in this series tries to capture the immediate impact of the lockdown on real estate sector, the steps taken by the companies to deal with the lockdown and plans of developers on treading over the next 6 months to reduce the impact of this pandemic.

Figure 1: Profile of the participant developers

98% of the survey respondents were active in the residential segment. A large part of the participants in the survey were in business for more than 10 years, had close to 50 employees and a turnover in the range of INR 10-50 Crores, predominantly having a local or regional presence. Majority of them had less than 1 million sqft under construction and these projects are spread across various stages of construction.

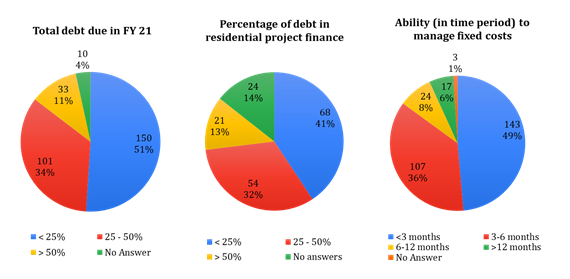

Figure 2: Financial Position of Residential Developers

A key finding of the survey was on the financial position of the participant developers. According to them their residential projects were funded by less than 50% debt. Also, more than half of the respondents (51%) said that they had 25% or less debt due in FY21. On one hand it is a positive sign that most of these developers are not under huge debt burden and with the extension of term loan moratorium announced by the government should be able to sail through the next 6 months. On the other hand, it also meant that majority of these developers were dependent on customer payments to fund these projects. A complete standstill in sales during the lockdown (as per 73% of the respondents) and fear that the slowdown in sales may continue in the coming months is likely to impact project cashflows. Their liquidity position during this survey was sufficient to take care of fixed costs and debt servicing for only upto 3 months.

This has made resumption of sales an important part of recovery efforts. While a few developers are offering discounts on sale price, others are incentivising buyers through various offers. The ‘stay home stay safe’ slogan during the lockdown has also brought to the fore the importance of ‘home’ as a safe haven during this pandemic. It has had a subliminal impact on end-user demand for residential properties especially in the affordable and mid-segment. Developer incentive along with a low home loan interest rate regime is likely to make the next 6 months the best time to buy homes.

But this pandemic has presented the developers with another challenge - the need for physical distancing and contactless interaction, increasing the importance of digital customer interface in the real estate industry. While some of the larger developers, especially in the luxury segment who have dealt with Non-Resident Indian (NRI) and High Networth Individual (HNI) clients in the past, already have developed comprehensive infrastructure for online sales, virtual tours and contactless transactions; the focus is now on mid-segment and smaller developers across geographies.

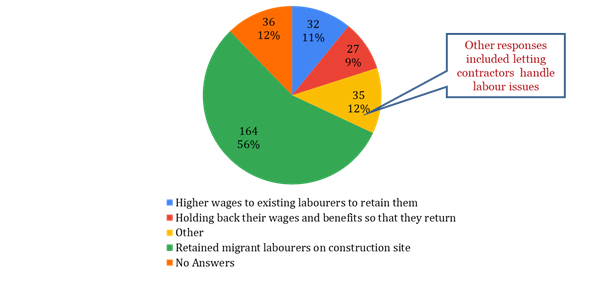

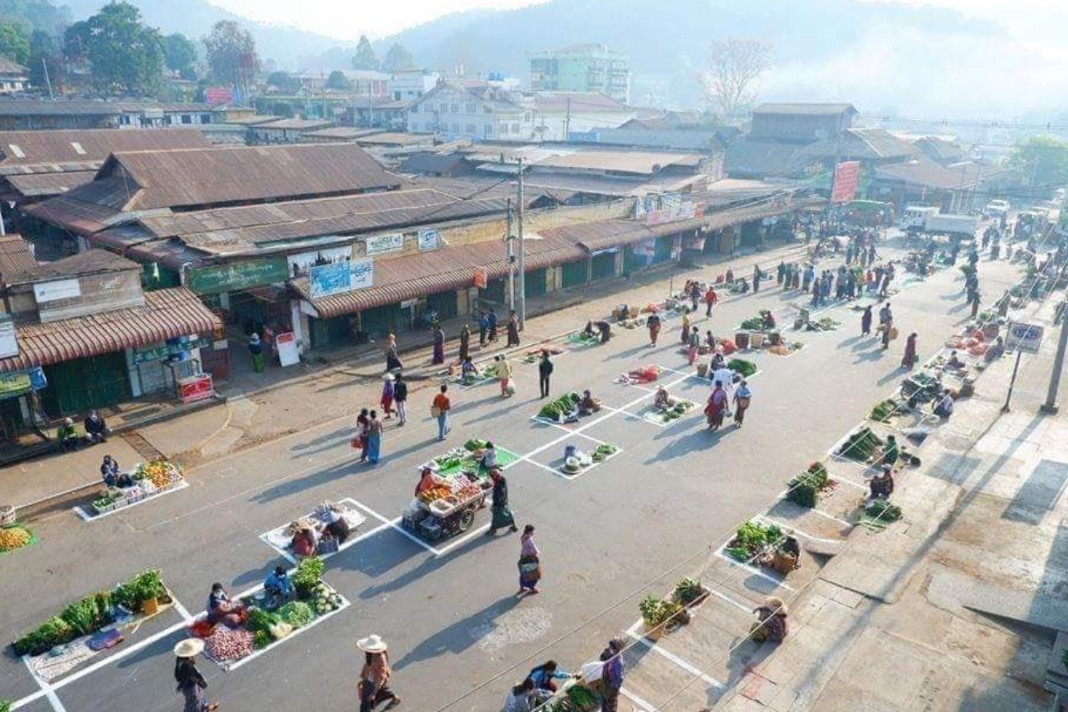

Figure 3: Plan for availability of migrant labour post lockdown

Indian cities witnessed a mass exodus of migrant labourers during the lockdown. Real estate sector is one of the largest employers of migrant labourers. Our survey results show that 56% of the respondents chose to retain migrant labourers on site by providing them accommodation, food and basic sanitation facilities during the lockdown. However, it is unclear how many of the labourers chose to stay back post the lock down as a result of misinformation and poor coordination between authorities. Bringing back migrant labourers and restarting construction activity on site is the second key challenge that the developers face during recovery which can result in significant delay and cost overruns. Restarting activities on site have to be carried out in a phased manner prioritizing projects that are nearing completion. A long-term solution is to employ technology in construction activities to reduce over-dependence on labour and ensure timely delivery.

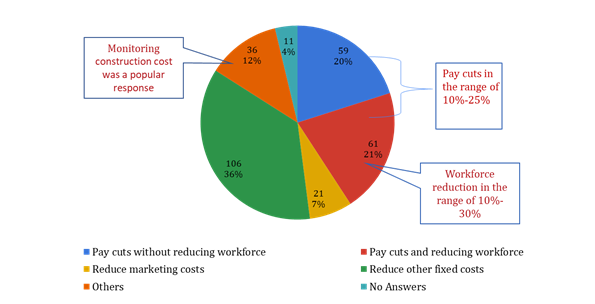

Figure 4: Steps by companies to ensure profitability

This brings us to the third key challenge of cost control – both fixed cost and construction cost. On the fixed cost front, at least 41% of the respondents considered pay cuts in the range of 10%-25%. The second option was to reduce fixed costs such as rents and utilities by opting for work from home options. A fifth of the respondents also considered downsizing in the range of 10%-25%. Monitoring construction cost is also a major challenge over the next six months due to disruptions in supply chains, labour shortage and mounting finance costs.

The above challenges have highlighted the fact that India’s construction sector which is poised to be one of the largest globally, is still highly conservative about adopting new technology. According to an International Labour Organization (ILO) report published in 2018, India’s construction sector has high automation potential, but the rate of adoption has been very low due to the fear of disrupting labour markets1. This crisis has presented the developers with a unique opportunity to rethink their business strategies and to integrate technology in all aspects of their business.

The next blog will address policy related issues based on this survey.

Reference:

1Emerging Technologies and Future of Work in India, ILO, June 2018.

Shwetha Pai

Venkatesh Panchapagesan